Medical

About Us

Sustainability

Governance

The Eiken Group conducts its business activities in accordance with the"EIKEN WAY", which is enshrined in its management philosophy, management vision and motto. To come to grips as an organization with the environment, society and governance (ESG), the Group establishes a sustainability policy and, by contributing to solutions to social issues, strives to achieve a sustainable society and improve the sustainability of its enterprise value.

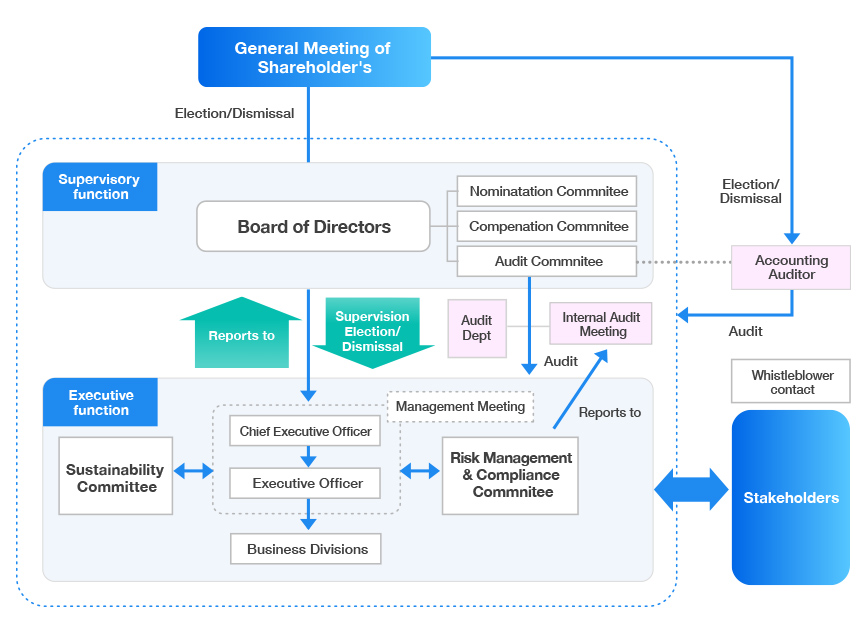

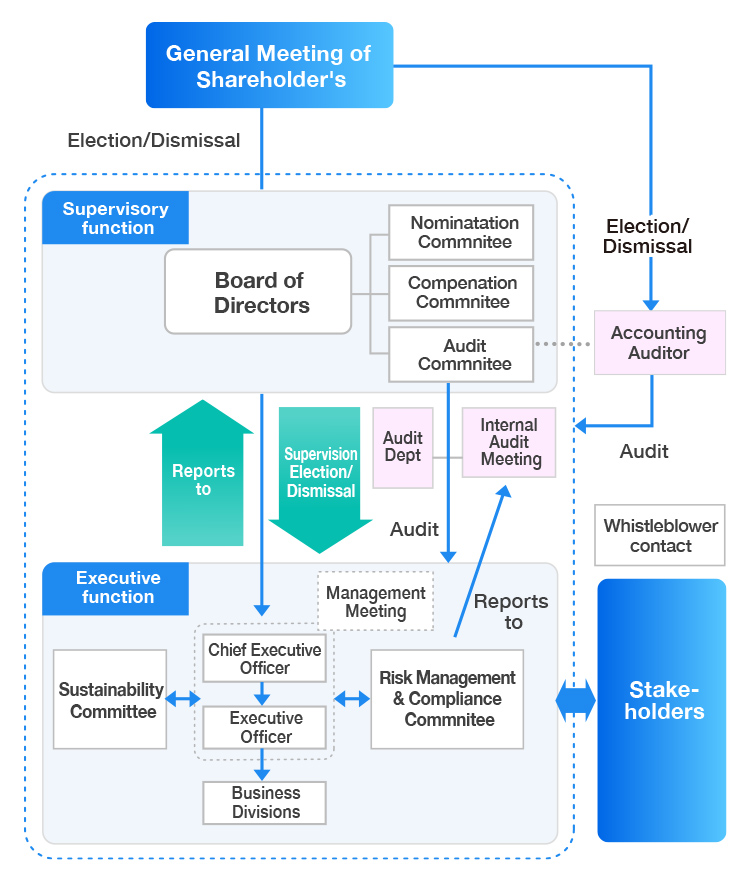

Eiken Chemical Co., Ltd. recognizes that corporate governance with a strong focus on the shareholders’ perspective is one of its most vital management issues for the purposes of enhancing management soundness, speed and transparency and improving enterprise value, and carries out activities on that basis. For this reason, the Company is organized as a “company with nomination committee,” maintaining separation of the executive and supervisory functions of management. Important matters related to basic management policy are decided through the deliberations of the Board of Directors, while execution of business is conducted swiftly and smoothly based on in-house rules and regulations and through an appropriate chain of instruction and command.

In accordance with its code of corporate governance, Eiken Chemical discloses governance-related matters through the publication of a Corporate Governance Report.

As a company with a Nominating Committee, etc., the Board of Directors appoints three internal directors and five outside directors. The Chairman of the Board of Directors is a non-executive internal director who is separate from the President.

The Nominating Committee consists of three members, two outside directors and one internal director, and is chaired by an outside director. Based on the selection criteria, the Company decides on the content of the proposal at the General Meeting of Shareholders regarding the election of directors and the appointment of executive officers.

The Compensation Committee consists of three members, two outside directors and one internal director, and is chaired by an outside director. The Company has decided on policies for determining individual remuneration for directors and executive officers, as well as individual remuneration.

The Audit Committee consists of four members, three outside directors and one internal director, and is chaired by an outside director. The Board of Directors decides on matters related to the basic policy and implementation plan for audits, as well as the content of proposals such as the appointment of an accounting auditor to be submitted to the General Meeting of Shareholders. With regard to conflict-of-interest transactions by Executive Officers, the "Executive Officer Regulations" stipulate that when an executive officer intends to enter into a transaction with the Company, he or she must disclose important facts about the transaction in advance and obtain the approval of the Board of Directors.

Corporate Governance Report(Last Update: June 25, 2025)

Eiken Chemical is organized as a company with nomination committee. The Company determines remuneration for directors and executive officers on an individual basis in accordance with the resolutions of the Remuneration Committee, a majority of whose members are outside directors. To incentivize executives to bolster the Company’s business results and contribute to shareholder value, the criteria for determining remuneration are decided in consideration of each executive’s responsibilities based on factors such as rank and executive duties, the Company’s business results, the management environment and industry norms.

Remuneration for directors and executive officers is composed of fixed pay, performance-based pay and remuneration through transfer-restricted shares. In the model case for these types of remuneration, their ratio is 55% fixed pay, 30% performance-based pay and 15% remuneration through transfer-restricted shares. However, the ratio of actual amounts paid may differ from individual to individual.

With a strong awareness of the sustainable improvement of shareholder value and corporate value over the medium to long term, the ratio was changed to 50% fixed pay, 30% performance-based pay and 20% remuneration through transfer-restricted shares at the Remuneration Committee meeting held on May 23, 2024, in order to increase the ratio of restricted stock compensation.

For outside directors, whose position is independent of business performance, pay is not lined to performance and consists of fixed pay only.

1Fixed pay

Fixed pay is a fixed amount paid each month. It differs for directors and for executive officers and varies according to rank and duties.

2Performance-based pay

Performance-based pay is paid to full-time directors and executive officers. As an incentive to improve business results each fiscal year in a sustainable fashion, it is decided as a total amount based on the indices of achievement of targets for consolidated net sales and consolidated operating income in each fiscal year, degree of improvement over the previous fiscal year, the progress of materiality, ROE, which the Company regards as an especially important management index.For executive officers, criteria are added that measure achievement of strategic targets that cannot be measured using financial figures for business results, such as efforts to reorganize the Company’s operating base to achieve sustainable growth. As such, performance-based pay for executive officers is assessed and paid according to degree of achievement of duties assigned to each individual. The Company plans to introduce evaluation of sustainability.

3Remuneration through transfer-restricted shares

The purpose of remuneration through transfer-restricted shares is to clarify the incentives for directors (except outside directors) and executive officers and align their objectives of with those of shareholders, thereby motivating these officers to maintain keen focus on sustainably improving medium-to-long term shareholder and corporate value.

Total amount of compensation, etc. by officer category, total amount by type of compensation, etc., and number of eligible officers

| Officer category | Total amount of compensation, etc. (Millions of yen) | Total amount by type of compensation, etc. (Millions of yen) | Number of eligible officers (persons) | ||

|---|---|---|---|---|---|

| Fixed Compensation | Performance based compensation | Restricted Stock-based compensation | |||

| Director (Excluding outside directors) |

48 | 39 | 2 | 6 | 3 |

| Executive officers | 262 | 109 | 91 | 61 | 10 |

| Outside directors | 51 | 51 | − | − | 5 |

FY ending March 2025

(Notes)

1. The amount of compensation, etc., for two directors who concurrently serve as executive officers is included in the amount of compensation, etc. for each after separating compensation, etc. as a director and compensation as an executive officer.

2. The amount paid by Executive Officers does not include the salary of employees of Executive Officers who also serve as employees.

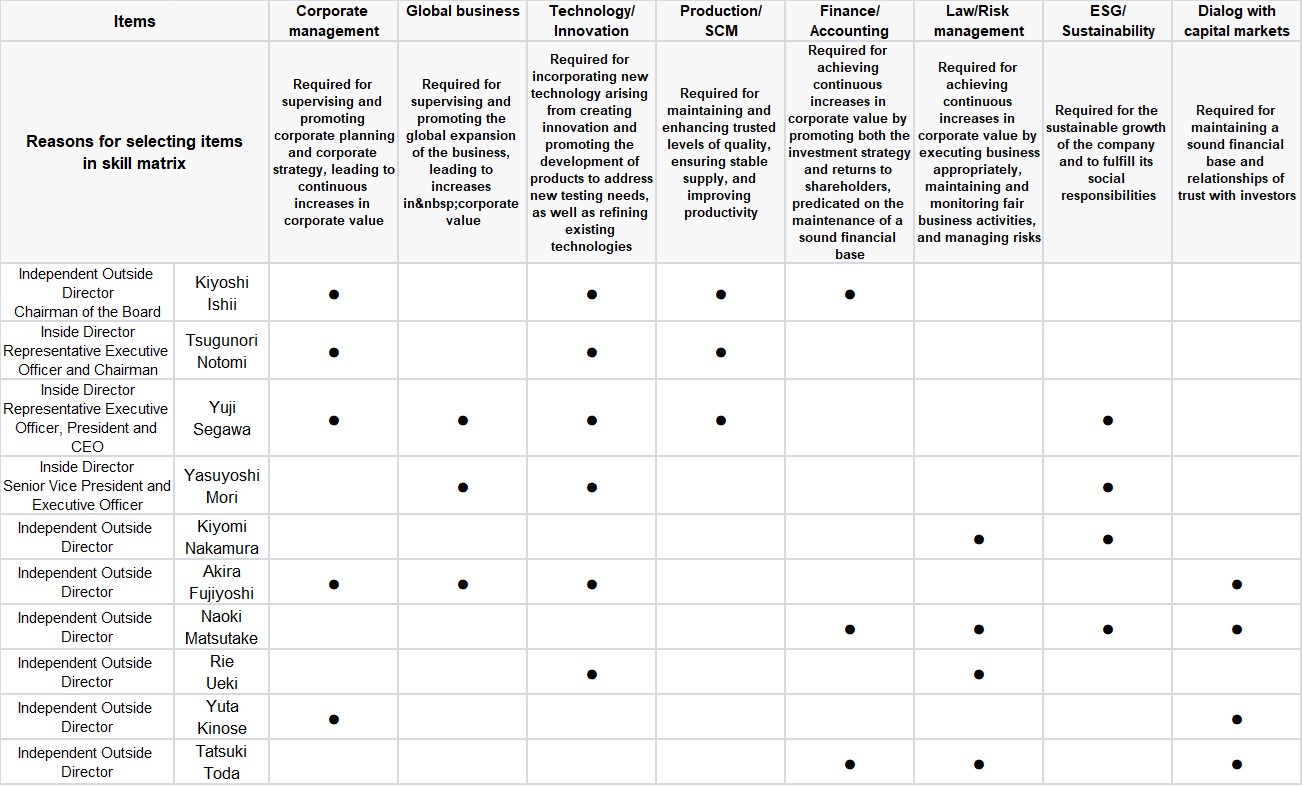

The composition of the Board of Directors of Eiken Chemical is well balanced in terms of knowledge, skills and experience in global business and sustainability, as required to achieve the Company’s management policy and management plans based on the management vision. Its members were selected with an emphasis on diversity, including diversity of gender, nationality, professional background and age. Nominees for in-house director are chosen for their ability to fulfill the roles of deciding important matters of corporate management and supervision of executive officers in the execution of their duties. Outside directors are nominated for highly specialized knowledge, skills and abundance of experience that cannot be obtained from in-house directors alone. Each director is expected to leverage his or her capabilities born of experience to maximum effect to decide important matters of basic management policy and supervise the execution of duties.

The Board of Directors appoints executive officers in consideration of executive-officer selection criteria, following consultation with the Nomination Committee regarding each candidate.

| Results for FY2024 | Target for FY2027 | Target for FY2030 | |

|---|---|---|---|

|

Female directors as share of directors |

20% | 20% | 30% |

|

Foreign-national directors as share of directors |

− | − | 20% |

|

Female executive officers as share of executive officers |

− | 10% | 30% |

|

Foreign-national executive officers as share of executive officers |

− | − | 20% |

Notes on the director skill matrix